-1658120666.jpg)

Bitcoin's four-day winning streak snapped on Sunday with the largest cryptocurrency tumbling below $21,000. Bitcoin was recently trading at about $20,800, down more than a percentage point over the past 24 hours, although still higher than it stood before starting its mini-rally on Wednesday.

Market observers see the crypto continuing to trade in the $18,000 to $22,000 range that it has maintained for a month, at least until investors have a clearer sign whether central banks can lick inflation without casting the global economy into recession.

"While Bitcoin saw positive momentum this week, it remains range-bound when you take a broader view, and is still struggling to cross the $22,000 resistance," Joe DiPasquale, the CEO of crypto asset manager BitBull Capital, wrote to CoinDesk.

DiPasquale noted optimistically that "BTC managed to stay strong," despite the recent gloomy inflation report that affected stocks and other high-risk assets. "For now, we remain interested in the bottom of this range when it comes to Bitcoin's price, and are monitoring for accumulation during this range-bound movement."

Ether, the second largest crypto by market cap, was recently changing hands at roughly $1,350, flat over the same period. Most other major altcoins were in the red with UNI and AAVE off approximately 2.5% and 3%, respectively.

Cryptos veered slightly from stocks' path as major indexes closed solidly in the green on Friday, with the tech-heavy Nasdaq and S&P 500, which has a heavy tech component, climbing 1.7% and 1.9%, respectively, and the Dow Jones Industrial Average rising over 2%.

The gains reversed some ground lost earlier in the week as investors tried to reconcile the latest data showing inflation still on the march and disappointing earnings among major brands in a range of industries with more encouraging signs that the global economy may not be cratering anytime soon.

On Wednesday, the Bureau of Labor Statistics' consumer price index showed June inflation rising 9.1%, a 40-year high, with core goods and services, such as food and energy rising at an even faster rate.

The University of Michigan's widely watched, monthly consumer sentiment index remained near its all-time low in its most recent release Friday.Yet the job market and retail spending have remained strong, indicating that the economy is still expanding.

Crypto news remained largely bleak, even without the continued afflictions of crypto lender Celsius, which filed for Chapter 11 bankruptcy protection on Wednesday, and crypto hedge fund Three Arrows Capital, which filed for Chapter 15 bankruptcy earlier this month.

Among other, more recent developments, Russian President Vladimir Putin signed a law banning digital payments across the nation, according to a policy amendment on Thursday.

The legislation prohibits the use of digital securities and utility tokens as a means of payment for goods, services and products in Russia. BitBull's DiPasquale will be eyeing the possible impact of the U.S. central bank's expected interest rate hike later this month on bitcoin pricing.

The bank's Federal Open Market Committee, which sets monetary policy, meets next Tuesday and Wednesday and is widely expected to raise interest rates by at least 75 basis points in its quest to stem inflation.

"If Bitcoin does not break down from this range by the end of the month, especially post the FOMC, we could see it as a strong sign of a potential long-term bottom," DiPasquale wrote.

Here’s Why the ICO Crypto Crash of 2018 Can’t Happen in 2022 Digital assets crashed hard in 2018 as a result of the bursting of the 2017 Initial Coin Offering (ICO) bubble.

As students of crypto history know, once ICO projects finished their token sale they converted their treasury to dollars, and this rapid glut of bitcoin and ether on the market crashed prices leading to the crypto winter of 2018-2019.

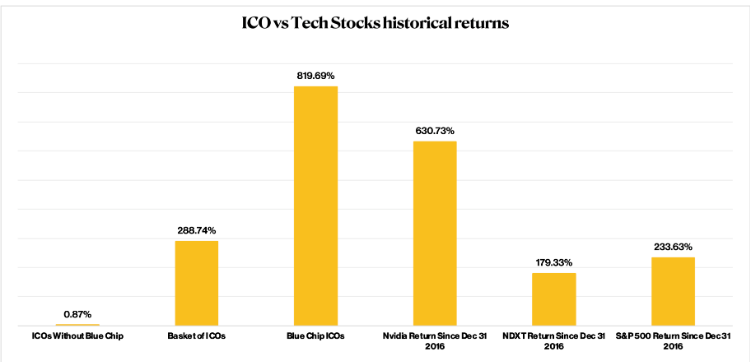

Those who had a broad portfolio of these ICO tokens and HODL’ed them through the dark days of that crypto winter came out well ahead, beating the stock market, even high-growth tech stocks that had their best days between 2018-2020, by a mile.But there were also plenty of retail investors that got burned.

Not just on fraudulent tokens of which there were many but on the rapid plummeting of crypto prices. A big part of the crash, and subsequent winter, was that the infrastructure at the time wasn’t very sophisticated compared to what’s available now.

As bad as the market correction of 2022 is, what happened in 2017-2018 was minuscule as far as market capitalization goes. “The environment in the current crypto ecosystem vastly differs from the heyday of ICOs in 2018," Singapore-based Danny Chong, co-founder of DeFi protocol Tranchess, told CoinDesk.

"Market maturity has driven the need to establish stronger technological foundations to be laid which have enabled exchanges and DeFi protocols to provide a variety of products, with lending, bridging, and liquid staking abilities, to reduce price fluctuations.”

Chong also points to the availability of more blockchain ecosystems beyond Ethereum that help shield the market from such rapid declines as experienced during the days of ICOs.“Although the perceived domino effect hasn't changed since the ICO crash, the impact felt by institutions and retail investors is relatively less in 2022," he said.

One key piece of infrastructure that didn’t exist during the ICO bubble was automated market makers (AMMs). These autonomous trading mechanisms are more efficient than a centralized order book, and prevent price slippage, by providing a readily available pool of deep liquidity to traders.

When a seller can’t find a buyer on a centralized marketplace, the price keeps dropping until there’s a match. AMMs would slow down this price slippage by providing liquidity to absorb the sale acting as a counterparty. This liquidity could be used for future transactions, or redistributed to other pools.

Right now, Unisawp has around $3.6 billion in value locked across dozens of pools, with most major digital assets represented. “AMM models continue to improve over time and are more efficient than order book algorithms,” a person identifying themselves as "Puff,"

who claims to be the lead contributor to the DeFi protocol Iron Bank, told CoinDesk. “DeFi has had five years to showcase its ability to handle volatility in both directions.”And where was the genesis of most of these protocols? The crypto winter that chilled the market after the ICO crash. One has to wonder what will be built during this market downturn. - coindesk